Finances are stressful. Let’s do them together.

$1 Million Savings Challenge

💰

$1 Million Savings Challenge 💰

“For once I don’t feel dread looking at my bank account.”

- Clem

“The act of tracking all my purchases in this app has helped me stick to a budget for the first time in my life.” - Jill

“It’s so FAST!” - Molly

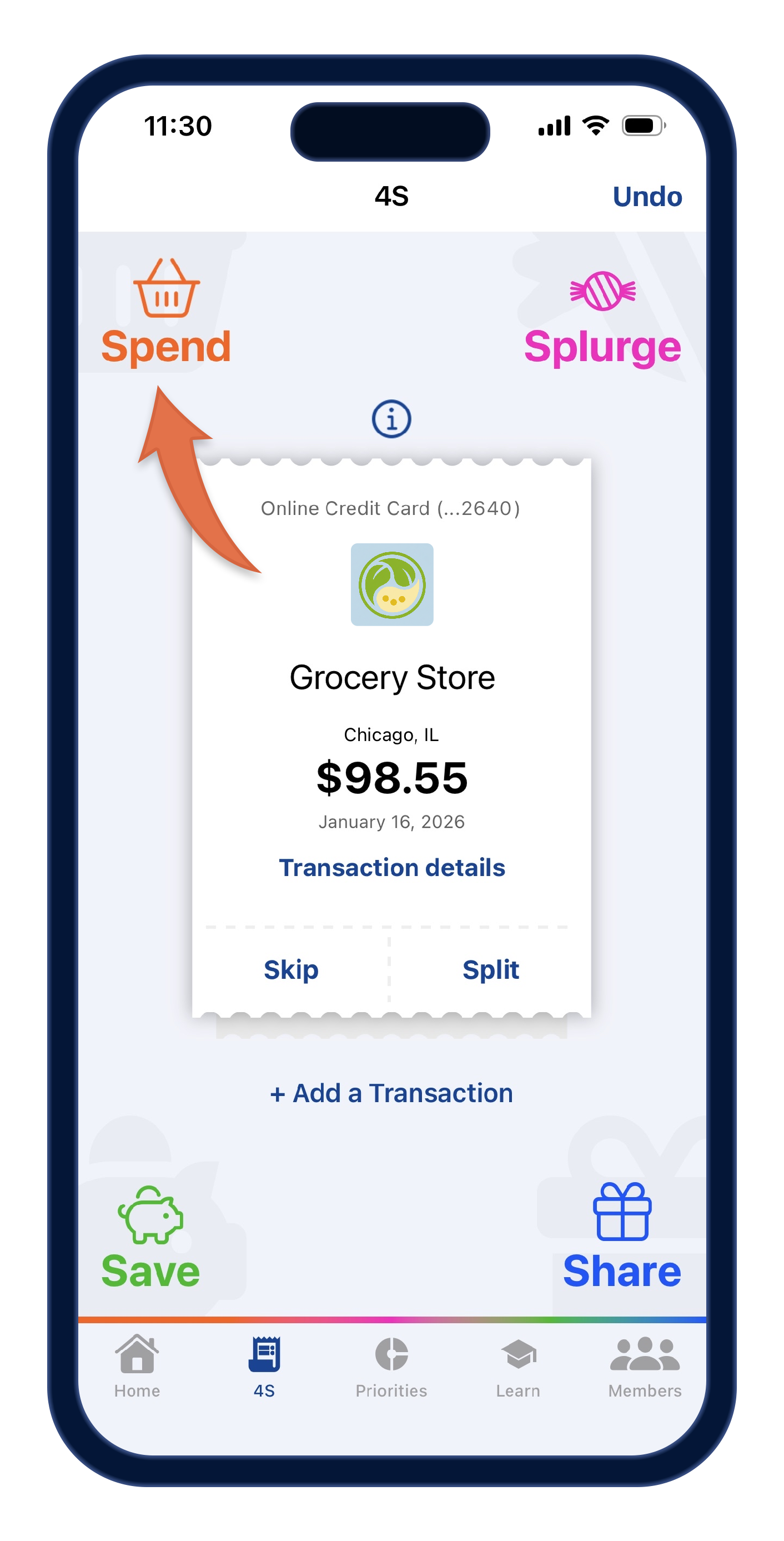

Simple

Track income and expenses with just four categories

Spend

Save

Splurge

Share

Fast

Swipe to quickly keep track on the go

Flexible

Choose your targets, adjust anytime

Motivating

Celebrate your wins

Priorities Calculator 🎯

Find the budget percentages that work for your income

|

Monthly income

|

$

|

|

Spend

|

|

|

Splurge

|

|

|

Save

|

|

|

Share

|

included in Splurge

|

MERIT$: Middle Earners Rich in Time

From our CEO

Honestly, I think finances are a huge pain. But everyone has to make and spend money, including those of us whose incomes are somewhere in the middle. Most painful things are easier and more fun when you don’t have to do them alone. Isn’t that why we go to group workout classes?

We’re building the first community finance platform for MERITs. Follow me, let’s figure it out!

Christine Devane

Founder & CEO

Expert in Residence

We’re proud to partner with Misty Lynch, Certified Financial Planner® as we build the future of community finance. Misty is CEO of Sound View Financial Advisors, LLC. She’s the author of the book Demystifying Money and hosts a podcast by the same name. She’s a personal finance resource for media outlets including The New York Times, Cosmopolitan, CNBC, CNN, Investopedia, Real Simple, Student Loan Hero, and many others. Investopedia named her one of the Top 100 Financial Advisors in 2021 and US News and World Report called her one of the 9 Women in Finance to Follow "because sometimes you need life advice, not just financial advice."

Misty Lynch, CFP®

FAQs

-

Club Money is a community approach to reducing financial stress. Members get customized recommendations as part of a group, while keeping their information private. Instead of personal finance, it’s more like social finance. We work exclusively with Certified Financial Planner® professionals.

-

Club Money delivers customized, easy-to-understand financial check-ins, all within an app. We focus on making everyday money decisions less stressful. Recommendations might include how to set financial goals, manage income and expenses, save more money, optimize savings across cash and retirement accounts, and pay down debt.

While you might learn more about different types of investments and how they work, Club Money does not provide investment advice. That means no stock tips, no insurance policies, and no crypto strategies.

-

Understanding your spending is a key first step in any financial plan. Club Money’s 4S method of swiping expenses to Spend Splurge Save and Share is simpler and more engaging than a traditional budget.

-

A Certified Financial Planner® (CFP) is a financial advisor with the credentials to provide holistic financial planning services. CFP professionals help people with all aspects of money management, from goal setting to saving to long-term planning.

-

Club Money is for everyone! Each group in Club Money is a safe space to ask questions, anonymously, and get money tips together with people who are similar to you.

Stop sweating, start saving

Get started with a 14-day free trial, then $8.99/month

Always ad free